NOUMI

Turning Emotional Spending into Empowered Choices: Designing Noumi from 0→1

Overview

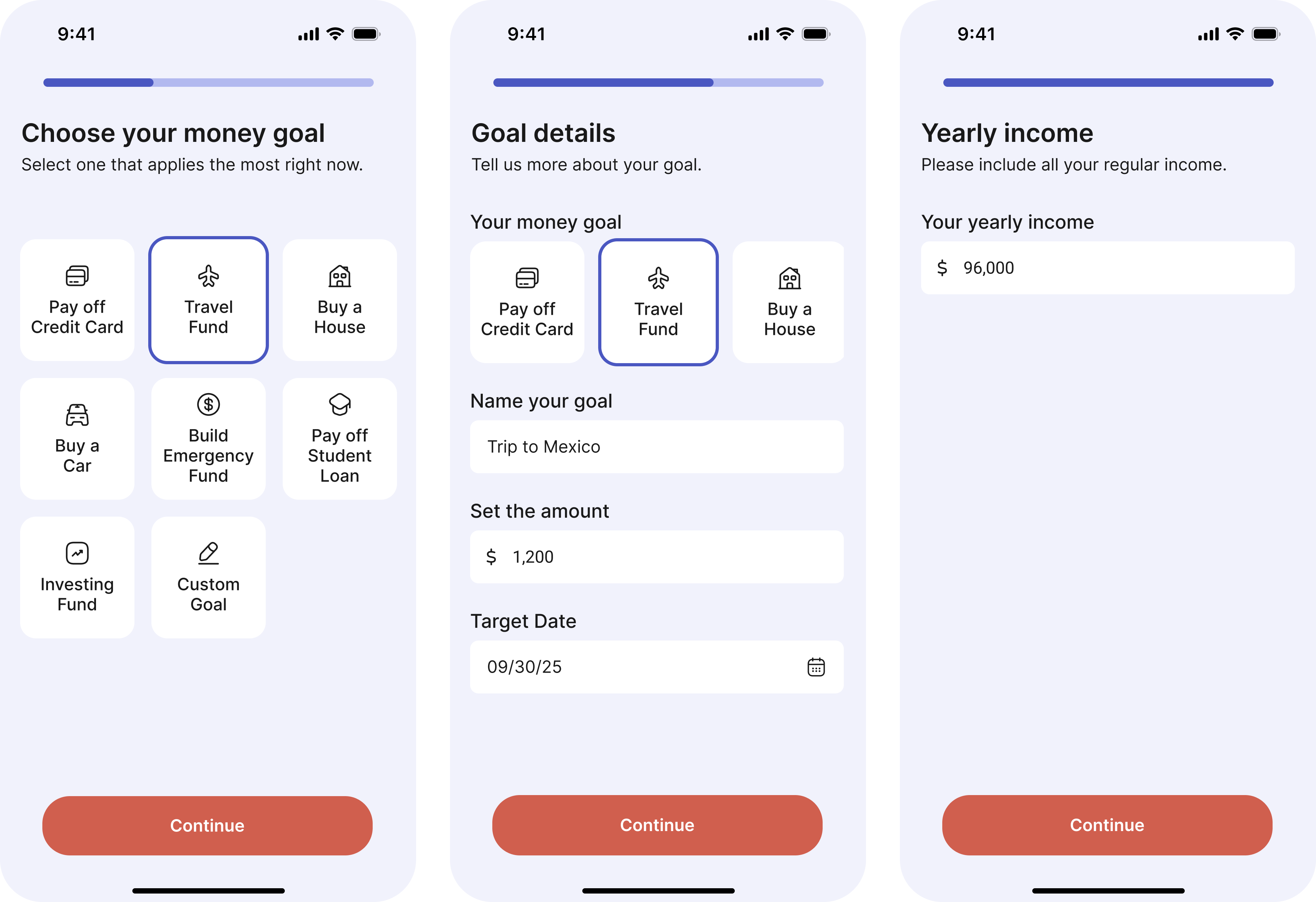

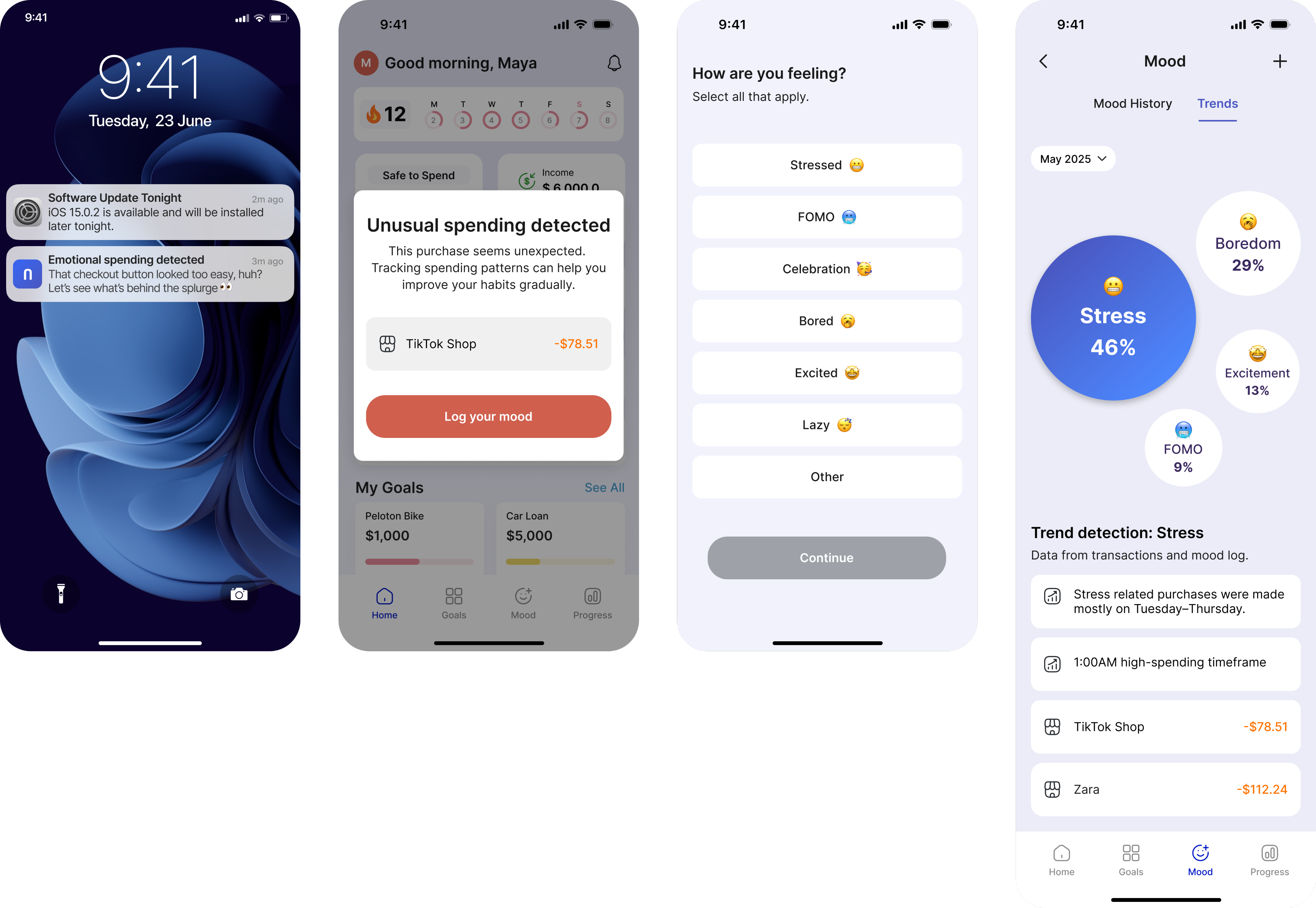

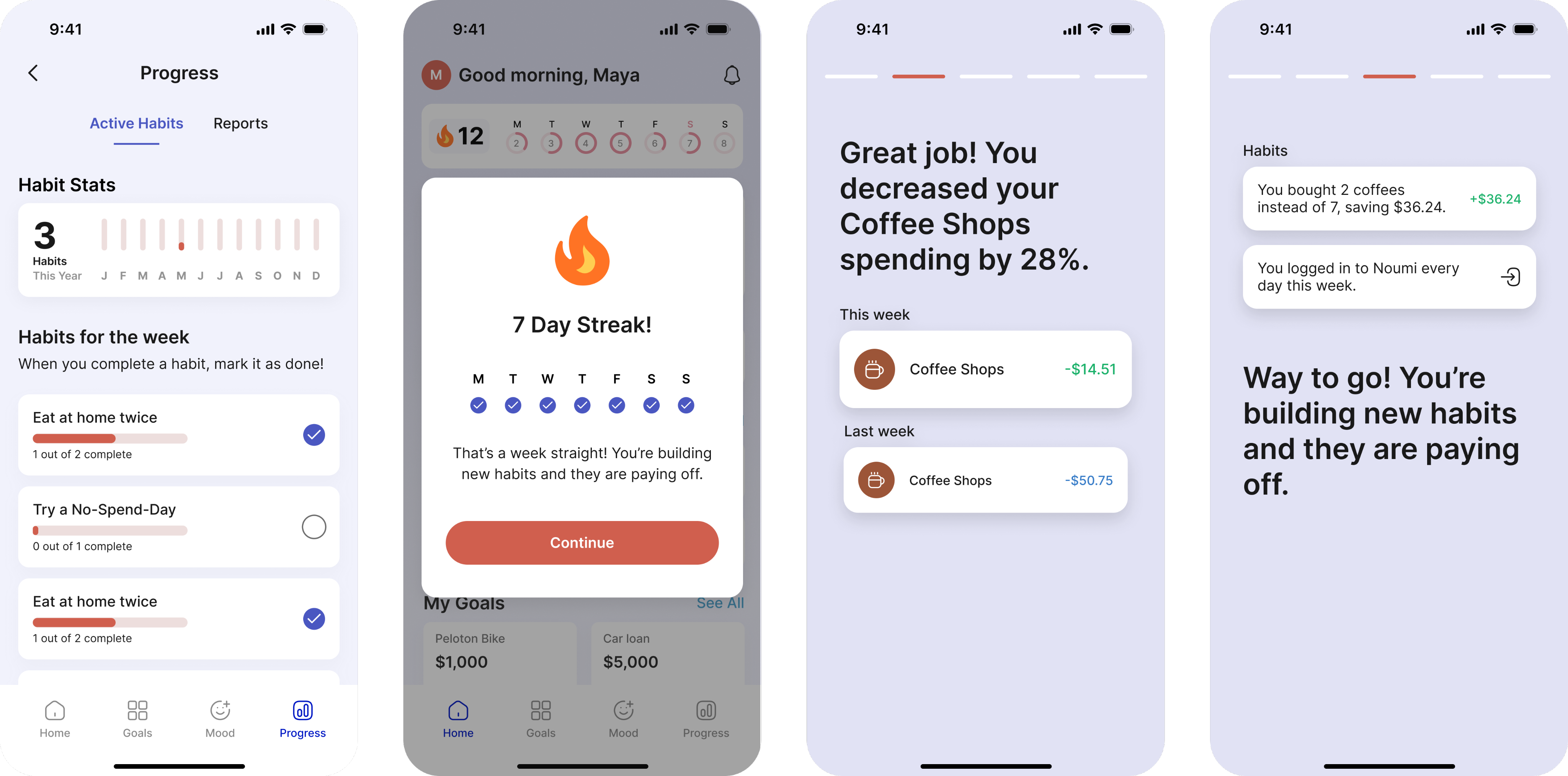

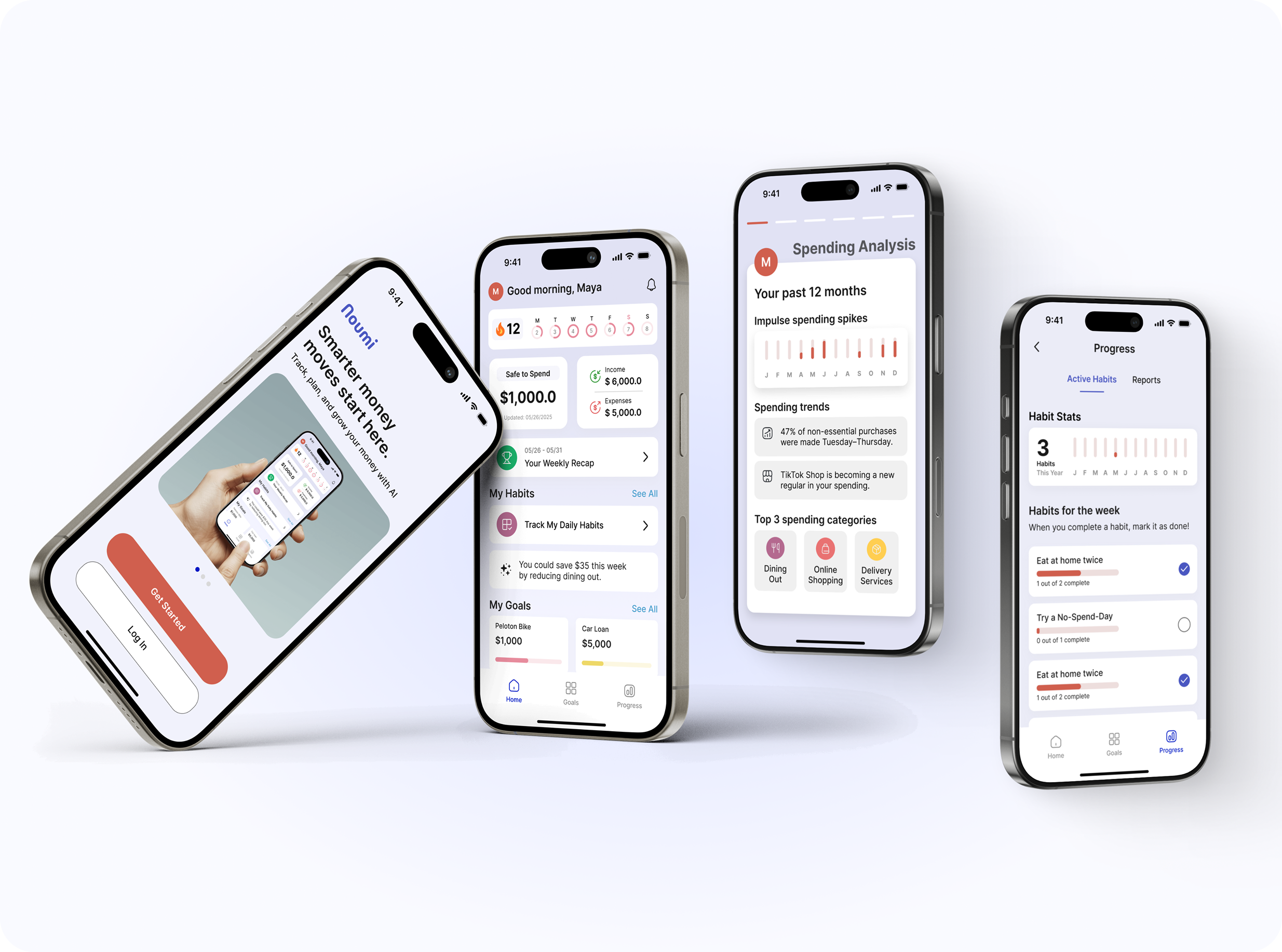

Noumi is a mobile fintech wellness app designed to help Gen Z and Millennial users better understand emotional spending and build healthier financial habits.

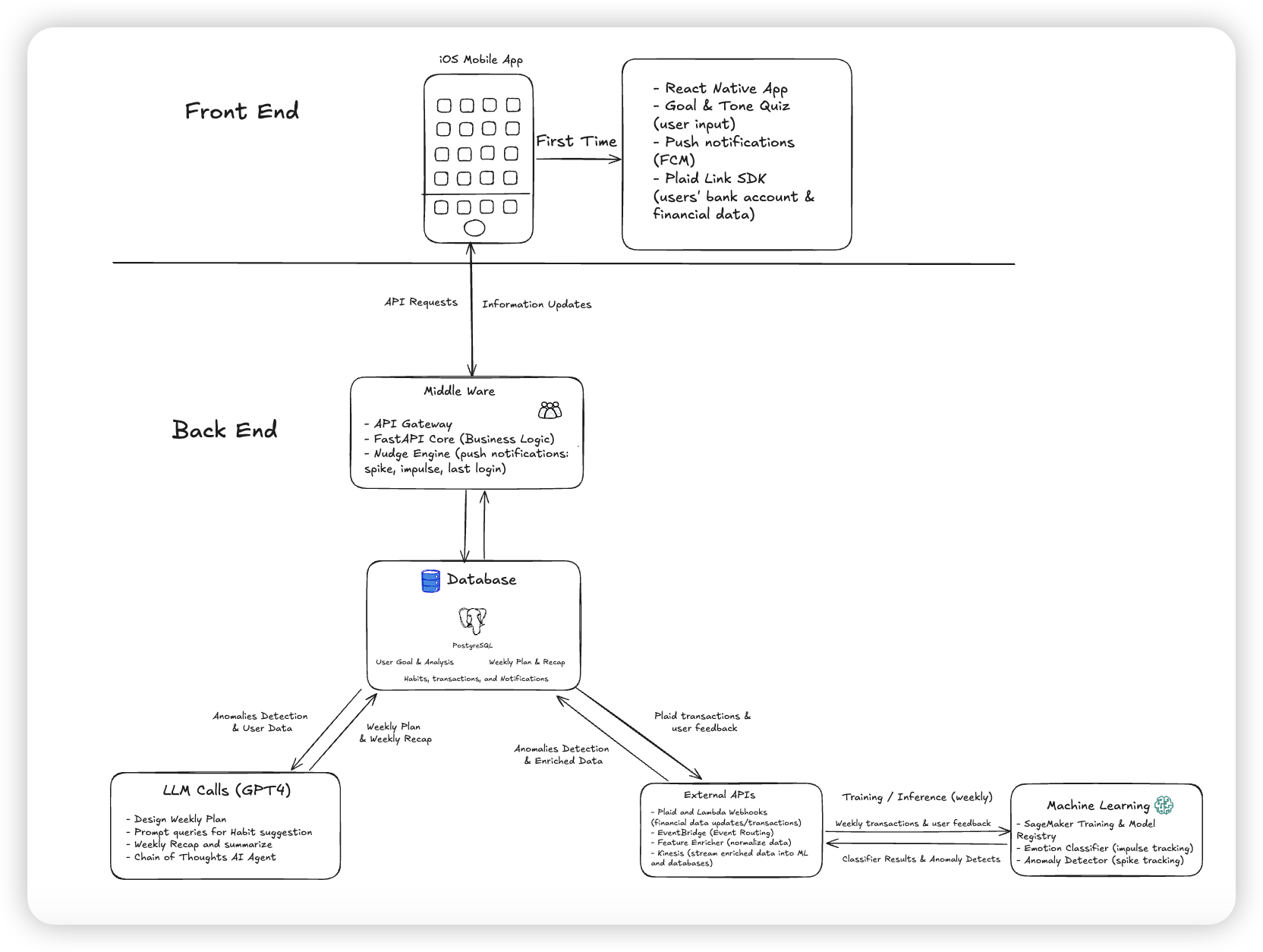

Unlike traditional budgeting tools that focus solely on numbers, Noumi uses AI to detect impulse purchases, forecast financial stress, and support behavior change through personalized routines and emotionally intelligent nudges.

Goals

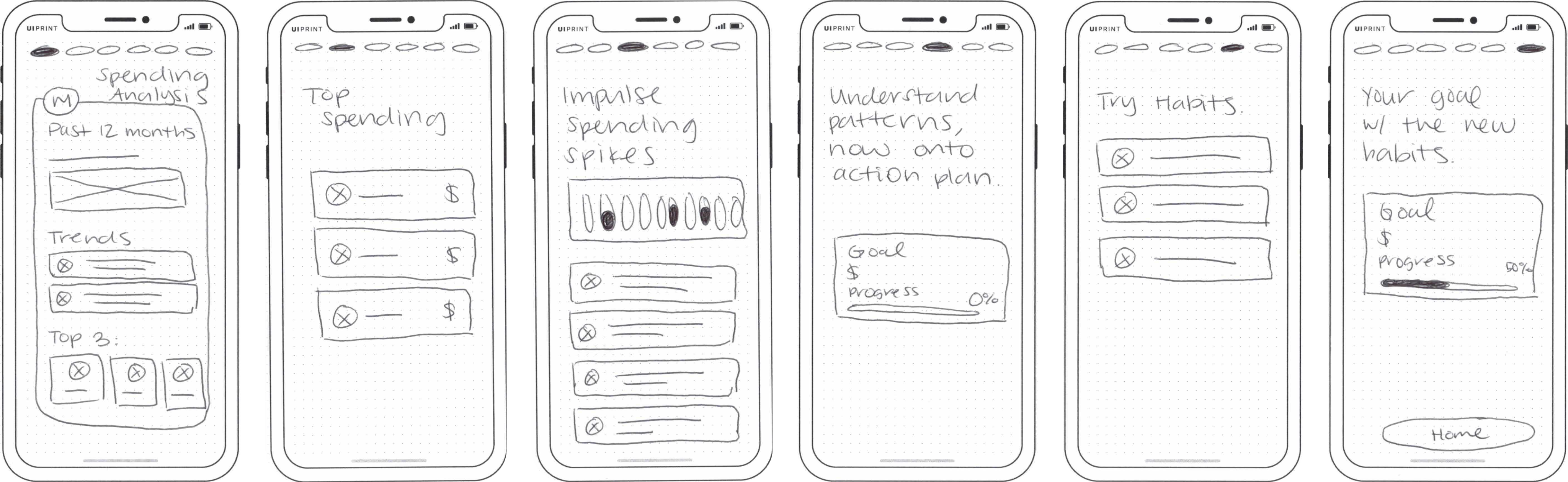

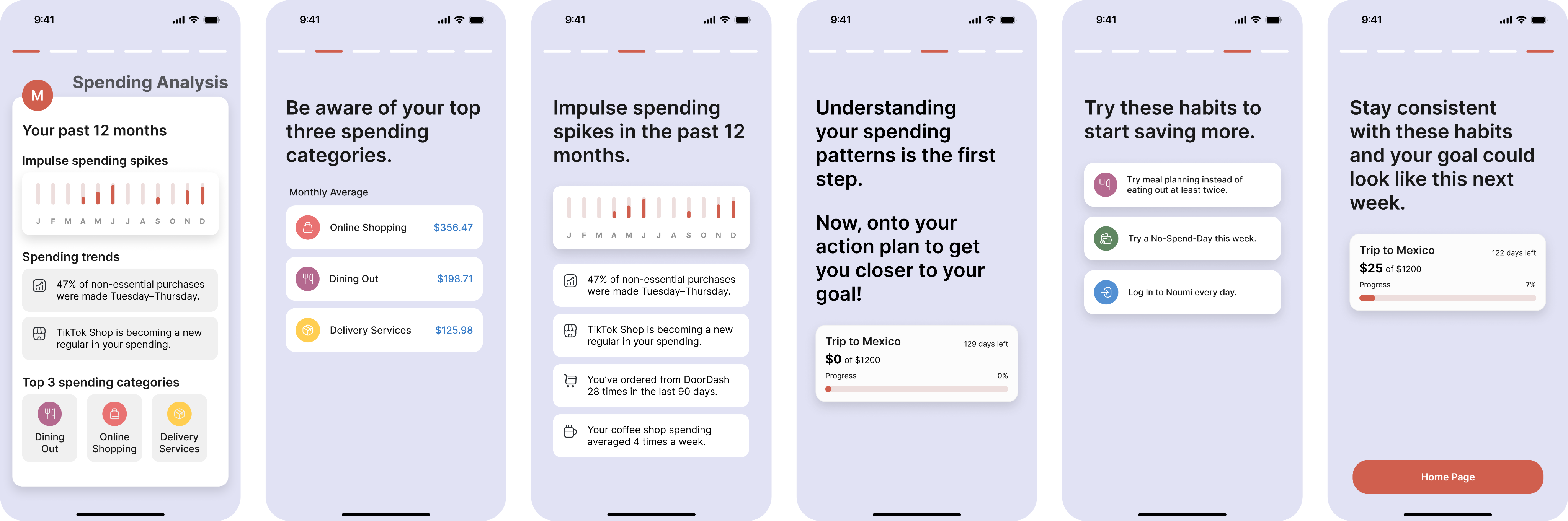

- Help users recognize and understand their emotional spending patterns

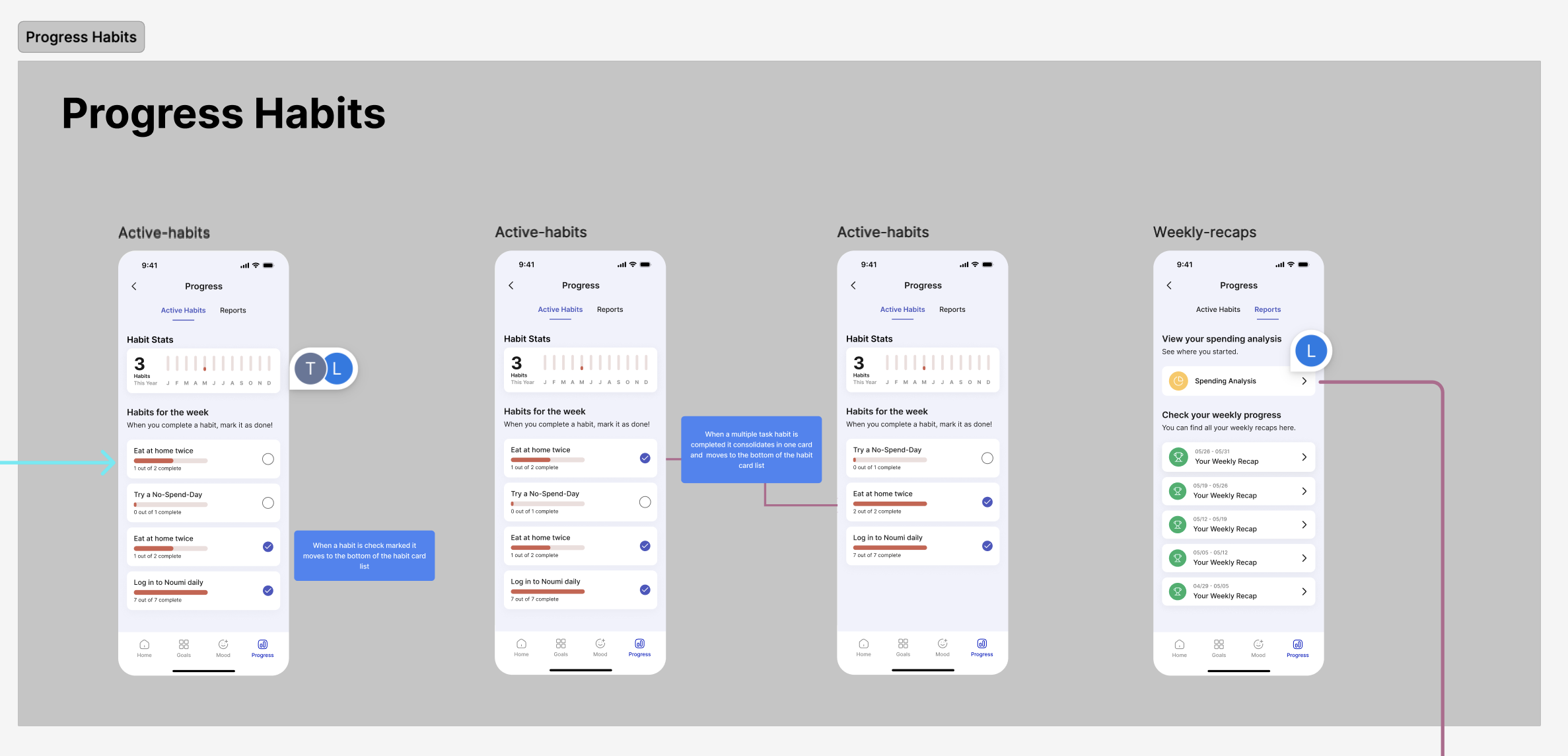

- Encourage healthy money behavior through personalized, easy-to-track habits

- Use past spending data to provide predictive insights and timely nudges that alert users to potential financial stress, helping them stay in control

- Create an app experience that is intuitive, motivating, and emotionally aware

- Launch a functional MVP integrated with live transaction data via Plaid

Role

Product Designer

Responsibilities

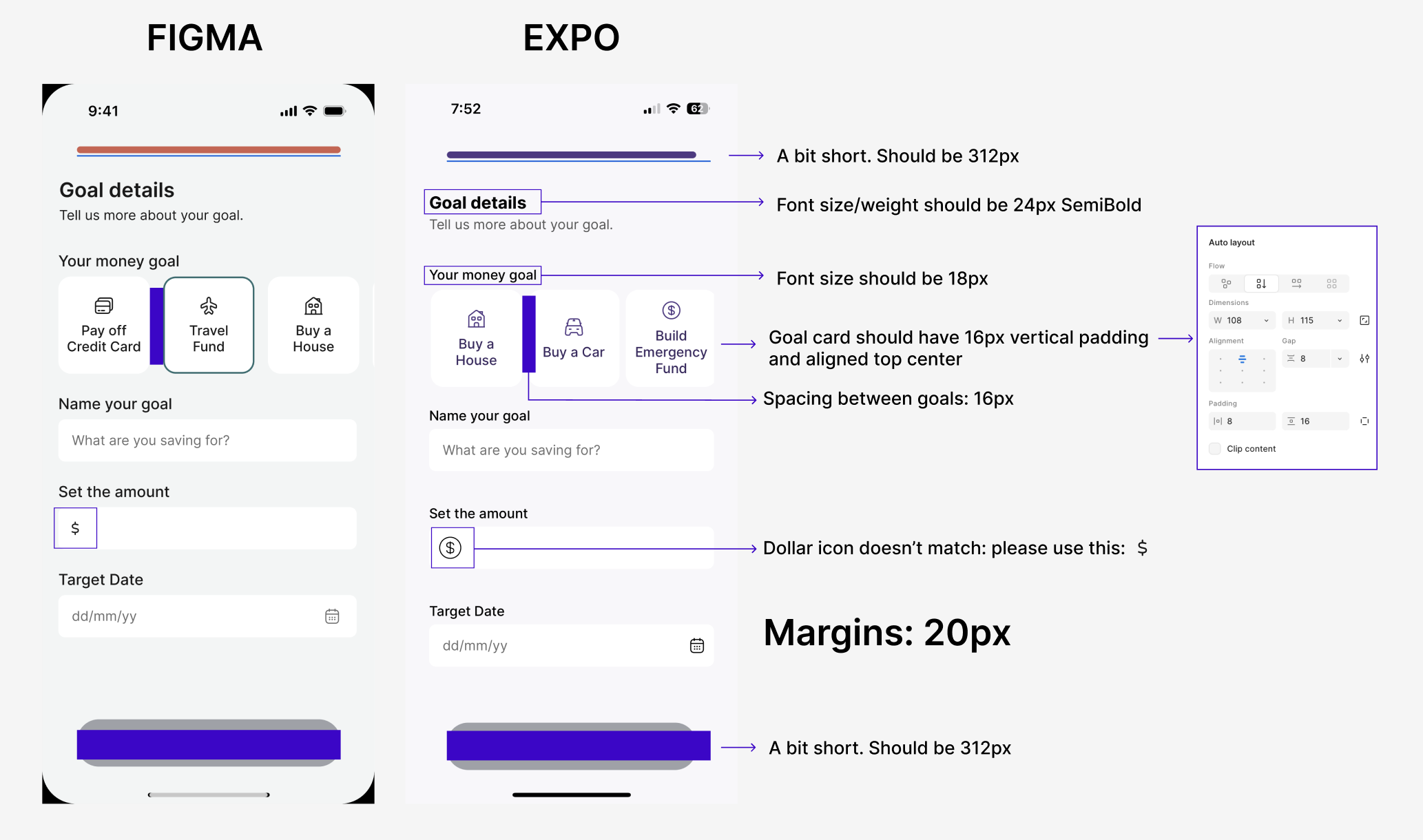

End-to-End UX & UI Design Process

Collaborators

Design, Product, and Engineering

Timeline

Apr 25 - July 2, 2025